r&d tax credit calculation example uk

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Each one is in a different industry.

To make an RD credit calculation you need to identify qualifying expenditure and enhance it by the relevant rate see below.

. A Profitable SME RD Tax Credit Calculation Lets assume the following. 570000-375600194400 A useful crosscheck when all the RDEC is discharged at Step 1 is to look at the net RDEC. Loss before the additional deduction 50000.

Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230 deduction claim a tax credit. The Ace Example PLC after RD should be an accounting profit of 3240000 with CT due of 375600. 70000 - 24167 45833 x 14 6417 If the company had no research expenses in any of the previous three years the tax savings is 6 of qualified research expenses for the current year.

With Corporation Tax at 19 youll be expected to pay 123500. The company can surrender the lower of the enhanced RD relief or the taxable losses for the period. Enhanced loss including additional deduction 50000162500212500.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. However RD tax credits are calculated differently to profit-making companies.

For example software companies that invest in their technology. The losses are surrendered for a cash credit tax credit payable and the current rate is 145. 10000 x 130 enhancement rate 13000.

Loss-making SME with 10000 RD spend. If you spend 200000 on RD you can knock just under 50000 off your Corporation tax bill for that year. In these circumstances the rate of relief equates to broadly 33.

Artificially increasing your RD expense for the year and reducing your taxable profit. Corporation Tax at 19 370000 x 19 70300 24700. They pursue innovation in their own way and have faced different challenges.

The UK Government introduced research and development tax credit schemes RD schemes in the year 2000 to encourage scientific and technological innovation within the UK. RD tax credits are calculated based on your RD spend. Social FinTech Beam Beam is social innovation at its finest.

So if your RD spend last year was. Using the same qualifying cost additional deduction and enhanced expenditure. Profit before RD 130000 RD Enhanced Deduction 100000 x 230 230000.

The rate of relief is 25. Tax calculator Contact us Contact us Get a quick estimate of your potential claim value Drag the slider or enter your estimated RD spend and click calculate to see your estimated claim value. The cash payment is.

If youre a loss-making business youll receive your RD tax credit in cash because you dont have a tax liability to offset. You might do this as a SME if you cannot claim RD tax relief for SMEs. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

Enhance your QE by multiplying by 130. Loss-Making SME Calculation Example 1. Sample calculations for RD tax relief claims.

According to the latest available figures UK companies claimed a total of 74 billion in the year ending March 2020 through the RD tax credit scheme. If your business made a loss it can still benefit from the government incentive. Your business spent 120000 on R.

____ Case Study One. The rate of relief is up to 33. This is a 19 increase from the previous year.

Here are some RD tax credit examples from a few of our clients. 100000 of costs are already included in the profit figure so only deduct 130000 370000. So as the enhanced RD tax relief is 230 a cash credit can be worth as much as 3335p for each 1 of eligible RD expenditure.

The net benefit to the company is the pre RDEC CT due less the post RDEC CT due. 1000000 Your spend estimate 50000. SME 1 made profits of 400000 for the year.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be. Is your company profit making. This produces your enhanced expenditure.

See details of example RD tax calculations. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. 23000 x 145 RD surrender rate 3335.

Deloitte pioneered the hiring of scientists and engineers to. Your business has made profits of 650000 for the year. Calculator - randd Eligibility Calculator RD Tax Credits are a very niche part of the UK tax code that could bring your company thousands of pounds in tax relief Complete the form below to find out how much you could claim.

A range of incentives are available to enhance tax relief or provide cash credits to businesses of all sizes that are involved in innovation. For a loss-making SME RD tax credits will be given in the form of a cash payment. SME RD relief allows companies to.

Corporation Tax Saved 95000 70300 24700. When subtracting it from the original corporation tax before the claim the total saving for this RD tax credit calculation example would be 24700. Subtract your original CT amount from your new rate to reveal your CT saving.

Assuming your business fits these criteria you can check below for example calculations for RD tax credits. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on. The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively.

The revised losses are surrendered to HMRC in exchange for this cash payment. RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime RDEC. RD Tax Credit is 287500 1454168750 CT600 boxes 530 875 Losses to carry forward 275000.

13000 x 19 corporation tax rate 2470. This organisation uses crowdfunding to raise money to assist homeless individuals. 10000 x 230 enhancement rate 23000.

Your claim estimate. Profit-making SME with 10000 RD spend. How much could you claim.

Tax benefits can vary between 8 - 33. Steps to calculate the RD tax credit via the traditional method 2 Total the QREs for the current tax year Determine aggregate QREs over a base period Divide the aggregate QREs by the aggregate gross receipts over the same period to determine the fixed-base percentage Take the lesser of the fixed-base percentage calculated or 16. When you deduct your enhanced expenditure from your taxable profits or add it to your loss it will result in.

This credit appears in the Internal Revenue Code section 41 and is earmarked for businesses that have costs related to research and development.

Sample Financial Statement Analysis Example Financial Statement Analysis Financial Statement Analysis

R D Tax Credit Calculation Methods Adp

Invoice Or Bill Discounting Or Purchasing Bills Trade Finance Accounting And Finance Financial Strategies

R D Tax Credits Explained How To Claim And Who Is Eligible

R D Tax Credit Calculation Adp

Woman Doing Accounting At Home In 2022 Accounting Services Accounting Business Tax

Preparing Financial Statements Principlesofaccountingcom Financial Statement Financial Online Textbook

Getting To Know Gilti A Guide For American Expat Entrepreneurs

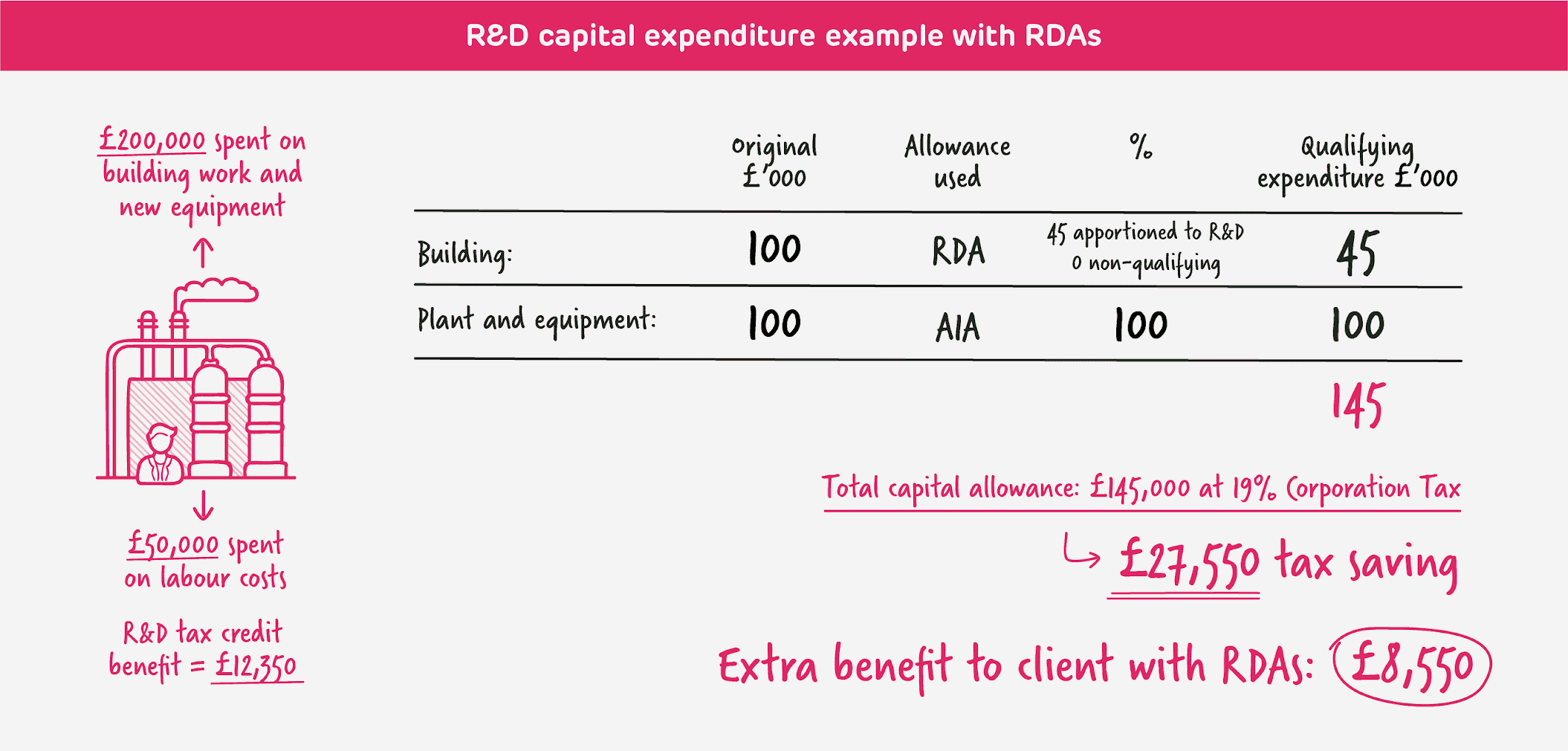

R D Capital Allowances R D Capital Expenditure Explained

Most Frequently Asked Questions About The R D Tax Credit Answered Warren Averett Cpas Advisors

Daily Sales Report Format Xls Restaurant Template Free For Throughout Free Daily Sales Report Excel Templ Sales Report Template Excel Templates Report Template

Financial Statement Financial Accounting Accounting Basics Accounting And Finance

1 Lifestyle Opportunity New Old Entrepreneurs Globally Trial Balance Financial Statement Trial Balance Example

Canada As A Clinical Trial Site Clinical Trials Site Clinic

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

Which Rating Scales Should I Use Rating Scale Research Writing Survey Design

We Review 50 Features Of Each Card To Compute Our Unbiased Genius Rating Calculate Rewards Best Travel Credit Cards Travel Credit Cards Compare Credit Cards